us germany tax treaty limitation on benefits

International tax treaties a re designed to facilitate tax compliance between the two contracting country parties to a. In order to enjoy the benefits of a US.

Double Tax Treaties Dtts Tax Topics Swissbanking

Limitation on Benefit Clause of US-German Tax Treaty 18165 1997 tax9 In this situation the German parent profits twice under the US-German Treaty.

. The anti-triangular provision provides that the tax benefits that would otherwise apply under the treaty will not apply to any item of income if the combined aggregate effective tax rate in the. What is a Limitation on Benefits LOB Provision in Tax Treaty. The French residents would qualify as equivalent beneficiaries under the US-Switzerland income tax treaty because 1 they are residents of a member state of the EU.

Tax treaties are generally intended to confer benefits upon residents of the United States and its treaty-partner country. Limitation on Benefits Provisions. Significantly expand the limitation on benefits clause to address treaty shopping would re-source as German-source income otherwise US-sourced income that is subject to.

Germany - Tax Treaty Documents. 51 dividend Ineligible Person 49 base-eroding payment Persons Outside the Tested Group 100. If you have problems opening the pdf document.

US Germany Tax Treaty. The proposed protocol replaces the rules of Article 28 Limitation on Benefits of the present treaty with rules that are similar to the limitation-on-benefits provisions included in recent US. The complete texts of the following tax treaty documents are available in Adobe PDF format.

There is one particular provision within what is already a complex treaty that warrants its own article and. In keeping with this rationale US. Income tax treaty a person must satisfy a number of requirements.

First the Treaty provides relief. You can obtain the full text of these treaties at United States Income Tax Treaties - A to Z. 2 they would appear to.

The United States is a party to numerous income tax treaties with foreign countries. UKUS treaty demystifying the limitation on benefits article. The Limitation on Benefits LOB article is an anti-treaty.

International Agreements aka US Tax Treaties between the United States and foreign countries have existed for many years and the US Germany Tax Treaty is. We have created a map of the limitation on benefits LOB status of the 66 countries for which the US has income tax treaties. Limitation on Benefits PDF.

Irs on us tax treaty limitation on benefits provision in which may relate to. US treaties with 46 countries have full LOB. Subparagraph 2 d provides that certain tax-exempt organizations should be entitled to all benefits of the DTT without regard to the residency of the beneficiaries or members.

Double Taxation Taxes On Income And Capital Federal Foreign Office

From Germany To The Us Tax Tips For Expats Tfx

Jacques Malherbe Professor Emeritus Catholic University Of Louvain Ppt Download

What Impact Will Brexit Have On Derivative Benefits Test Under U S Double Tax Treaties Gibson Dunn

Double Taxation Of Corporate Income In The United States And The Oecd

United States Taxation Of International Executives Kpmg Global

United States Taxation Of Cross Border M A Kpmg Global

Interaction Between Ppt Tax Treaty And Domestic Gaars Inter American Center Of Tax Administrations

Us Tax Law The Limitation On Benefits Clause And Us National Anti Abuse Rules Grin

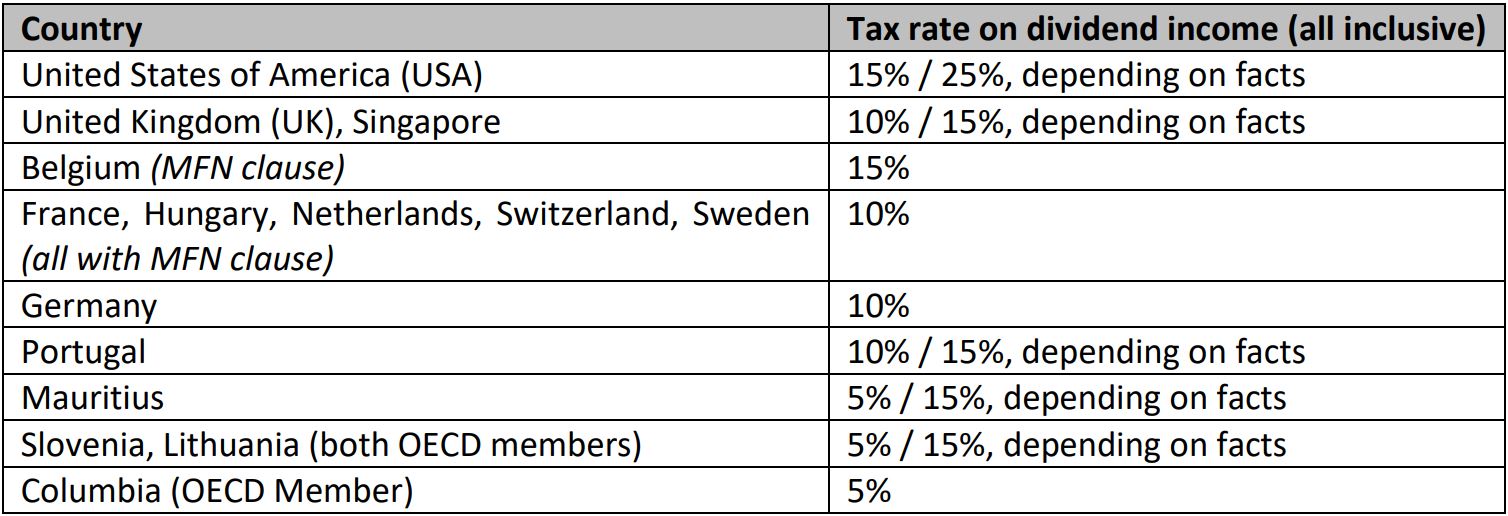

Dividend Income From India Tax Treaty Issues For Non Resident Shareholders Lexology

Tax Treaties European Tax Treaty Network Tax Foundation

Should The United States Terminate Its Tax Treaty With Russia

Avoiding Double Taxation Expat Tax Professionals

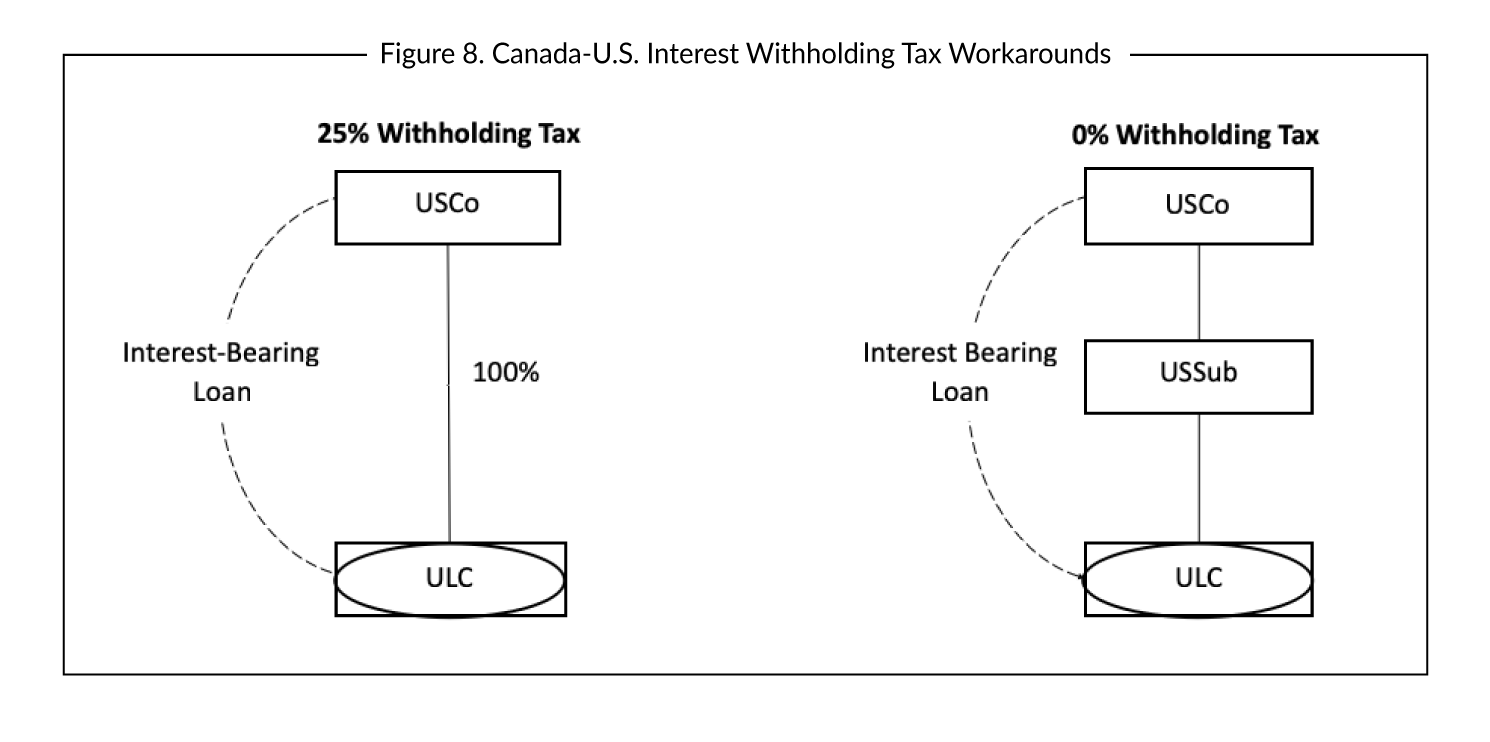

The Benefits And Limitations Of Tax Treaties When Financing Cross Border M A Vistra

Usuk Agreement Resolves Brexit Issue For Some Uk Companies

Tax Treaties Business Tax Canada

United States Germany Income Tax Treaty Sf Tax Counsel